The realty

sector, which has recently garnered

attention due to strong infrastructure

development as well as rebounding demand in many other sectors like

retail, hospitality, infrastructure,

cement, etc., presents a hidden investment opportunity. The momentum that has developed following the pandemic,

according to Ansh Batra, Director, Buniyad Group, "appears only to be getting

stronger."

By 2030, India's

realty sector market is projected to be worth $ 1 trillion, up from $ 200 billion

in 2021, and to contribute 13% of GDP by 2025. The sectors of retail,

hospitality, and commercial real

estate are also expanding rapidly and are helping to meet India's expanding infrastructure needs. While the

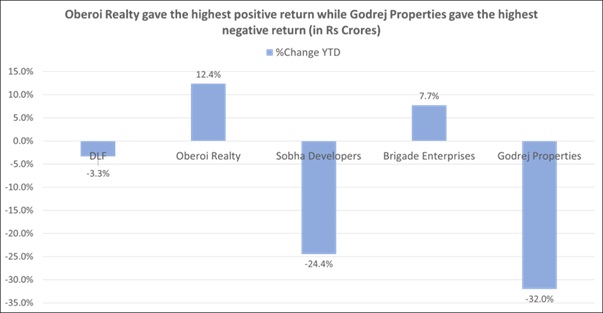

prospects sound robust, the realty stocks have given mixed returns

YTD, as they have seen major corrections & up moves in 2022 alone.

Even in the Q1FY23 results a mixed performance was

expected from the players in this sector. The National Logistics

Policy, which aims to facilitate a uniform regulatory environment and institutional framework controlling the

industry, is anticipated to encourage growth

of commercial real estate, such as warehouses and industrial parks, across both established and growing logistics markets.

So, let’s analyse the Q1FY23 performance of few significant realty players to understand the current

happenings in the market and check for possible investment avenues.

Revenue fell QoQ, while it grew YoY for all the players

in Q1FY23

DLF reported a revenue of Rs 1440 crores in Q1FY23 which

saw an increase of 26.5% YoY from Rs 1140 crores

in Q1FY22. While

their PAT grew 60% YoY at Rs 649 crores

in Q1FY23 up from Rs 337 crores in Q1FY22. On a

sequential basis their PAT grew 11.4% despite

revenue falling 6.8% QoQ.

During Q1FY23, DLF booked robust presales of Rs 2040

crores, up 101% YoY and -25% QoQ

& maintained FY23 presales guidance of Rs 8000 crores. It launched 0.7 msf

(million sq. feet), with 7.6 msf in pipeline for FY23 (6 msf launched

in FY22).

Oberoi Realty reported

revenues grew 221.2% YoY (up

10.9% QoQ) to Rs 913.1 crore led by

residential segment revenue recognition, which was at Rs 772.5 crore, up 265.5%

YoY (up 17.8% QoQ). While their

EBITDA margins, were up 10% YoY to 53.9% due to project mix. The reported PAT was at Rs 403.1 crore, up 400% YoY, given

strong operating profit growth and higher profit

from share of JV.

The company sold 4.01 lakh sq. ft area during Q1FY23, up

260% YoY (with total booking value of

Rs 761 crore). On a QoQ basis, sales volume has declined 23% with Worli project volumes

not taking off and sequential softness in Borivali/Mulund volumes.

Sobha’s Q1FY23 revenue came in at Rs 582 crores, up 13.5%

YoY & -20.5% QoQ, 23% (missed

estimates) and PAT at Rs 13.8 crores, up +28%YoY & -45% QoQ, (a 68% miss). This weak performance was largely led by muted completions in Q1FY23.

Sobha Ltd achieved Q1FY23 gross sales bookings of 1.36 msf worth Rs 1150 crores and is the best ever quarter for the company in terms of sales bookings. While the company had earlier guided for flattish gross sales volume of 5.0 msf in FY23E (4.9 msf in FY22) citing cost input pressures and rising mortgage rates, the strong start to FY23 has led to the company now guiding for 10-15% YoY volume growth and 15-20% YoY value growth in FY23.

Brigade Enterprises reported revenues grew 135.8% YoY to

Rs 902 crore, with revenue recognition

from real estate at Rs 655 crore, up 155% YoY. Their reported EBITDA margins were down 325 bps YoY to 25.8% (up 400 bps

QoQ) given the revenue mix. The company reported PAT of Rs 65 crores vs. loss in Q1FY22 & Q4FY22.

The sales value at Rs 814 crore was up 70% YoY.

Realisations were up 5% YoY at Rs 6589/sq. ft. The company reported sales volume of 1.24 msf, up 61% YoY. Modest

launch of

0.5 msf vs. 1.9 msf in Q4 led to QoQ volume

dip by 20%.

Whereas for Godrej Properties, revenue came in at Rs 245

crores, up 180% YoY & -82% QoQ.

Their EBITDA came in as Rs 14.2 crores in Q1FY23. Other income came in at Rs

180 crores up 3.4% YoY & -5.3% QoQ. Lastly,

their PAT was at Rs 43 crores,

up 150% YoY while

-83% QoQ.

Godrej Properties Ltd reported the best-ever first quarter presales of 2.8 msf, up 260% YoY &

-33% QoQ valued at Rs 2500 crores, with launch of three new projects across MMR

and Nagpur contributing Rs 1000 crores to sales.

Our View:

With demand being consistently

higher than supply in last few quarters, the inventory overhang has now come down to comfortable level of 15 months.

Moreover, affordability in Bengaluru

remains the highest, considering per capita income and average ticket size

being traded in the city, which provides

further comfort for developers to take gradual, but consistent price hikes. So, the players working here are ideally

better placed. It includes Brigade

group & Sobha group, both of them have neutral rating for fundamentals and short-term trend on Univest

App, while for the long term a bullish rating.

Additionally, the top six markets include Bengaluru, Chennai, Hyderabad, Mumbai, NCR, Pune. So, other players like Oberoi Realty have sound fundamentals as well bullish momentum on both long as well as short term. While for DLF & Godrej Properties, a neutral stance on fundamentals, as well as stock price trend can be seen on Univest.

About the Author

Ketan Sonalkar (SEBI Rgn No INA000011255)

Ketan Sonalkar is a certified SEBI registered investment

advisor and head of research at Univest. He

is one of the finest financial trainers, with a track record of having trained

more than 2000 people in offline and online models. He serves as a consultant

advisor to leading fintech and financial data firms. He has over 15 years of

working experience in the finance field. He runs Advisory Services for Direct

Equities and Personal Finance Transformation.

.JPG)

No comments:

Post a Comment